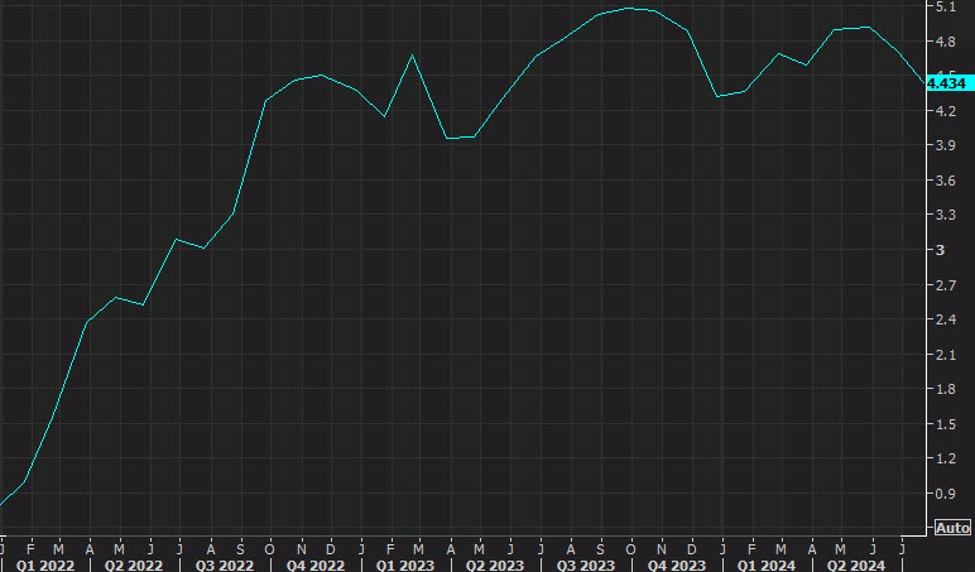

The front end is for sale today and this will be the first auction in awhile where the US Treasury can borrow at that tenor for less than 4{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea}. Last month, 2s sold for 4.43{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea} and today, we’re likely to track below 3.95{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea}.

The last sales below 4{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea} were in March/April 2023 on worries about US regional banks.

US 2 year auction history

Look for solid bids as BMO notes that only one 2-year auction has tailed over the past year, and only by 0.4 bps. Last month, there was a 2.5 bps sto through, which was the largest since 2009 and proved to be wise as 4.43{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea} certainly isn’t available today.

The bear case is that yields have moved down too quickly and aren’t yet justified with Fed funds still at 5.25-5.50{721fc769be108e463fe4e33f629fb22fe291c423a7a69eaaf65dcb28e9b05dea}.

“On net, we’re biased

for solid end-user demand but will look for a small tail at 1pm EST,” BMO says.