GBP/USD declines by over 0.50%, on sour sentiment due to Middle East tensions. UK Manufacturing PMI expanded but slowed, while US ISM Manufacturing PMI improved

Category: Resources

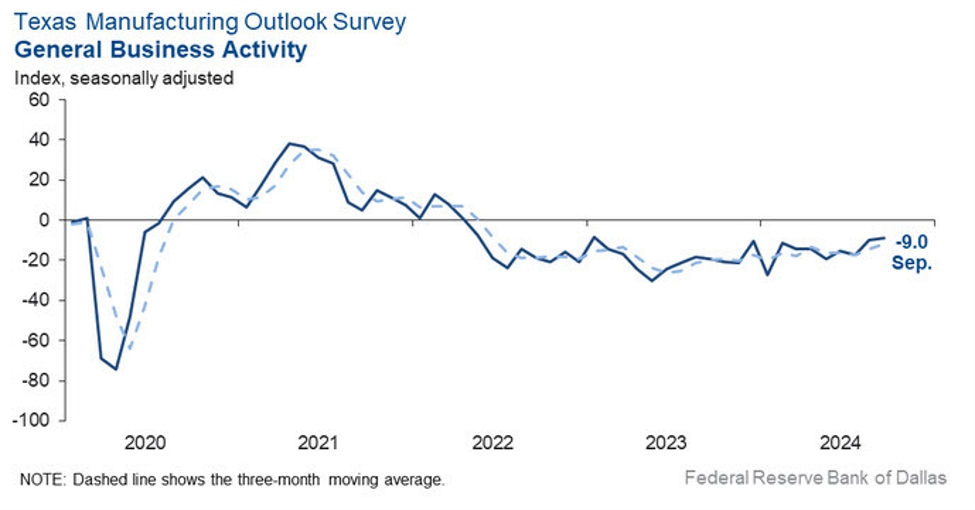

Dallas Fed September manufacturing index -9.0 vs -9.7 prior

Output (production) -3.2 vs +1.6 prior New orders -5.2 vs -4.2 prior Employment +2.9 vs -0.7 prior Outlook -6.4 vs -9.6 prior Prices paid for

Gold price plummets Friday, still eyes weekly gains over 1%

XAU/USD drops to $2,646 after September inflation data suggests progress toward the Fed’s 2% target. US 10-year Treasury yield falls five basis points, while the

Forexlive Americas FX news wrap: US PCE inflation cools

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and

PBOC sets USD/CNY reference rate at 7.0101 vs. 7.0354 previous

The People’s Bank of China (PBoC) set the USD/CNY central rate for the trading session ahead on Friday at 7.0101, as compared to the previous

BCA suggest that the stimulus announced from China is 1990s Japan all over again

In a note, analysts at Bank Credit Analyst suggest that the monetary easing measures introduced by the People’s Bank of China (PBoC) may offer a

Sharp bullish momentum seen and pair claims to highs since December

The NZD/USD pair has risen sharply to trade at 0.6340, a 1% rise, suggesting strong buying pressure. The RSI and MACD indicators are both sharply

The consolidation in USDCHF trading continues. What should traders look for going forward?

The USDCHF has been consolidating since August 20 or so with most of the price action between 0.8400 and 0.8537. That’s not alot of trading