- Output (production) -3.2 vs +1.6 prior

- New orders -5.2 vs -4.2 prior

- Employment +2.9 vs -0.7 prior

- Outlook -6.4 vs -9.6 prior

- Prices paid for raw materials +18.2 vs +28.2 prior

- Prices received +8.4 vs +8.5 prior

- Wages +18.5 vs +22.0 prior

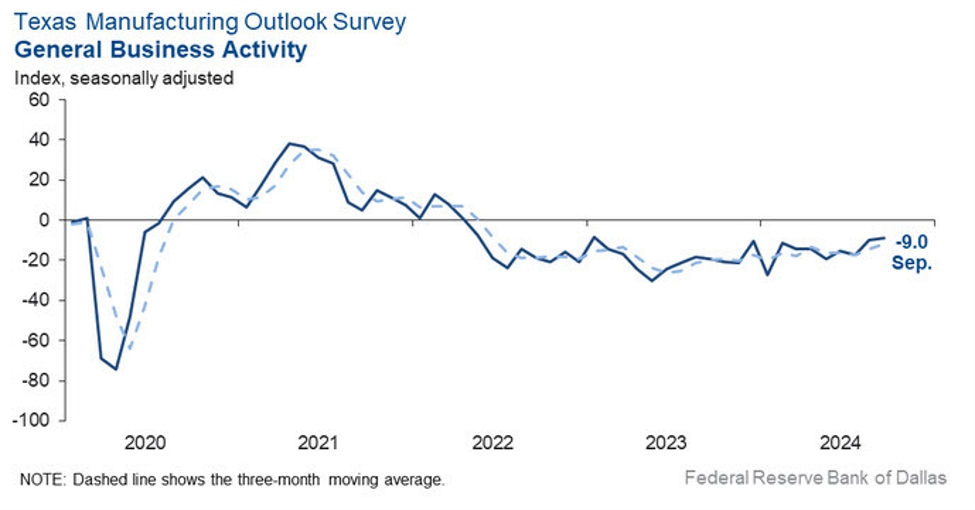

This is a neutral reading overall. There are some positive indications on the outlook and inflation but some drags from output and new orders. I’m surprised it was as strong as it is given the decline in oil prices.

All the sub-indexes are within recent ranges except this one:

Comments in the report:

Chemical manufacturing

- Increased imports [is an issue affecting our business].

- Regulation [is an issue affecting our business].

Computer and electronic product manufacturing

- We are seeing signals of the market inflecting up, but near-term, things remain muted.

- We look at the possibility of a [Kamala] Harris administration

with great concern. It will almost certainly lead to a reduction in our

general business activity. We sell into many industries, so while

“green” industries will be favored, we expect others (e.g., oil and gas)

to be politically disfavored, leading to reduced investment.

Fabricated metal product manufacturing

- Our system business has slowed, while our shop work is very

strong. We usually see large system work hold or decline in an election

year.

Food manufacturing

- Now that the Federal Reserve has started to lower interest rates,

I feel better about the overall direction of the economy. After the

presidential election, we will have a clearer perspective of what to

expect in the next six to 18 months. Now, what will happen with oil and

the Middle East? - Interest rates coming down is having a positive impact on capital expenditure and interest payments.

Machinery manufacturing

- Business remains slow, which will hopefully change after the election.

- The reality of a Democrat victory is disconcerting for our

customer base who have a legitimate fear of declining business

conditions going forward. That jeopardizes our forecast and

opportunities for success. It’s been quite a while since our customers’

sentiment has been this negative.

Nonmetallic mineral product manufacturing

- Improvements are only due to a new product line introduced. We have not seen any business or industry improvements.

Paper manufacturing

- We saw a slight uptick in activity from last month. This was before the interest rate movement.

Primary metal manufacturing

- We are using capital expenditures to add new product offerings to

offset dwindling legacy product. Oil and gas product demand is

shrinking. - All of the major markets we sell into continue to trend downward. That includes transportation and building/construction.

Printing and related support activities

- September will be slower with less billing than August, which is a

drag as it’s the last month of this fiscal year. We have been feeling

the slowness in estimating for a couple of months, and now we are

seeing the results. We are optimistic that six months from now we will

see better times, especially after the election.

Transportation equipment manufacturing

- The outlook is totally controlled by the November election.

- We are seeing constraint from large customers being practiced,

[with them] only ordering what’s needed immediately, not providing

forecasts and not sharing insight. Major customers have been impacted

by cyberattacks and ransomware incidents, shutting down operations in

August and September. - We are tied to the trucking/transportation industry. The market

continues to soften, with fleets holding onto cash. All other suppliers

to the market are seeing the same thing. Overall, the market is down

50 percent year over year.